Last weekend, in sunny Aix en Provence, IMF chief, Christine Lagarde hinted that the IMF is likely to reduce once again its forecast for global economic growth for this year and next. She said that “momentum could be weaker than expected”. Lagarde reckoned that the huge liquidity stimulus coming from the central banks (most recently a proposed $1.4trn liquidity injection by the ECB to stave off recession and deflation) would have “only limited impact on demand”.

Last April, the IMF forecast global output would grow by 3.6% in 2014 and 3.9% in 2015, down from previous forecasts. Now it appears that these will be lowered again later this month. So what was the answer to improving this growth, which will be way too low to get profitability of capital on a sustained upward path globally, let alone get global unemployment down and get real incomes per household up? Lagarde said the answer was “more public investment”! Pretty ironic as everywhere, governments are slashing public investment in order to meet fiscal austerity targets and ‘make room’ for private investment. Now the IMF says that countries should boost growth by governments investing in infrastructure, education and health, provided their debt stays sustainable. That’s because capitalist investment “remains subdued”.

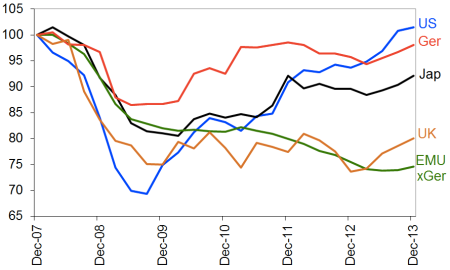

It sure does. US business investment has been the strongest in the current ‘recovery’ from the Great Recession (see my post, http://thenextrecession.wordpress.com/2014/03/30/us-business-investment-still-stuck/).

But even with some bounce-back since 2009, the level of US private investment remains low by historical levels. US GDP is now 13% below where it would be if it had remained on the average trend path from 1990-2007, with 3.9% points of that gap to a shortfall in business capital.

I have discussed in detail the reasons for low investment growth since the Great Recession despite apparently huge cash reserves and record profits being recorded by large US and European companies (see my posts, http://thenextrecession.wordpress.com/2014/03/24/awash-with-cash/ and http://thenextrecession.wordpress.com/2013/12/04/cash-hoarding-profitability-and-debt/).

Basically, it’s due to relatively low rates of profitability on new productive investment, especially compared to returns on financial speculation; low rates of interest allowing companies to stack up cash and take out more debt to finance share buybacks and financial asset purchases (the stock market is booming!); and still large accumulations of old capital and debt that must be deleveraged.

So it’s no surprise that Standard & Poor’s has issued a report in which it says that, although companies continue to have historically high levels of gross cash – $4.5tn at the top 2,000 capital investment spenders in 2013….

So it’s no surprise that Standard & Poor’s has issued a report in which it says that, although companies continue to have historically high levels of gross cash – $4.5tn at the top 2,000 capital investment spenders in 2013….

…. global capital expenditure this year is likely to fall 0.5% in real terms in 2014, having fallen by 1% in 2013. Capital expenditure by emerging market companies, having fallen by 4% in 2013, now seems likely to fall by a similar amount this year – the first significant reversal in the long-term upward-trend since the various emerging market crises of the 1990s. The decline in spending by emerging market companies is broad-based and has affected companies in Brazil, Russia, India and China.

One argument against the idea that capitalists are failing to invest enough has emerged. It is suggested that actually businesses are doing a lot of investment, but it’s often a form of investment that involves reorganizing their firm around new information and communications technology–whether in terms of design, business operation, or far-flung global production networks. And this does not cost very much and so does not show up in increased investment. Larry Summers (see my post, http://thenextrecession.wordpress.com/2014/06/14/doctors-without-diagnoses/) argues that “Cheaper capital goods mean that investment goods can be achieved with less borrowing and spending, reducing the propensity for investment.” In other words, the price of each unit of constant capital (Marx’s term for assets and technology) is falling, so the real cost of investment is stable.

One argument against the idea that capitalists are failing to invest enough has emerged. It is suggested that actually businesses are doing a lot of investment, but it’s often a form of investment that involves reorganizing their firm around new information and communications technology–whether in terms of design, business operation, or far-flung global production networks. And this does not cost very much and so does not show up in increased investment. Larry Summers (see my post, http://thenextrecession.wordpress.com/2014/06/14/doctors-without-diagnoses/) argues that “Cheaper capital goods mean that investment goods can be achieved with less borrowing and spending, reducing the propensity for investment.” In other words, the price of each unit of constant capital (Marx’s term for assets and technology) is falling, so the real cost of investment is stable.

Well, if that is so, it does not explain why global growth is slowing and well below the rate pre the Great Recession. Certainly, the IMF does not accept this benign idea that actually investment is rising sufficiently but we just can’t see it in the data.

Well, if that is so, it does not explain why global growth is slowing and well below the rate pre the Great Recession. Certainly, the IMF does not accept this benign idea that actually investment is rising sufficiently but we just can’t see it in the data.

That brings me to discuss the very important report that economists at the OECD released last week. Called, “Policy challenges for the next 50 years”, the OECD looked at where the capitalist world was going over the long term. And it’s truly scary for capitalism and truly awful for those generations who will live under capitalism up to 2060. To quote the OECD report: “In the period to 2060, global growth prospects seem mediocre compared with the past, with GDP in the OECD and the emerging G20-countries. The world is “likely to grow by 2.7% in 2010-2060, compared to 3.4% in 1996-2010. Global GDP is expected to grow by 3.0% per annum 2010-2060, leading to an increase in global GDP of 350%.” So a slowing capitalist growth rate, but still higher global GDP by 2060.

The OECD goes on: “While growth will be more sustained in emerging economies than in the OECD, it will still slow due to a gradual exhaustion of the catch up process and less favourable demographics in almost all countries. Population ageing will result in a decline in the potential labour force which can only partially be offset through increases in labour force participation and employment rates. Against this backdrop, future gains in GDP per capita will become more dependent on accumulation of skills and, especially, gains in multifactor productivity driven by innovation and knowledge based capita.” In other words, the capitalist world will slow fast and will be unable to meet the needs of 8 billion people unless it can get the productivity of labour up sharply through “innovation and knowledge-based” investment.

Well, as Paul Mason outlined in his excellent Guardian article on the OECD predictions (http://www.theguardian.com/commentisfree/2014/jul/07/capitalism-rich-poor-2060-populations-technology-human-rights-inequality), the OECD is really saying that “growth will slow to around two-thirds its current rate; that inequality will increase massively; and that there is a big risk that climate change will make things worse.” And “the growth of high-skilled jobs and the automation of medium-skilled jobs means, on the central projection, that inequality will rise by 30%. By 2060 countries such as Sweden will have levels of inequality currently seen in the US”. Also “the whole projection is overlaid by the risk that the economic effects of climate change begin to destroy capital, coastal land and agriculture in the first half of the century, shaving up to 2.5% off world GDP and 6% in south-east Asia.” (Mason).

Mason points out that the OECD’s assumption is that there will be a rapid rise in productivity, due to information technology. Three-quarters of all the growth expected comes from this. However, that assumption is “high compared with recent history”.

As I have discussed before, there are several studies that argue capitalism has exhausted its potential to develop the productive forces of human endeavour through innovation (see my post, http://thenextrecession.wordpress.com/2014/03/06/is-capitalism-past-its-use-by-date/). As Mason says “The OECD has a clear message for the world: for the rich countries, the best of capitalism is over. For the poor ones – now experiencing the glitter and haze of industrialisation – it will be over by 2060. If you want higher growth, says the OECD, you must accept higher inequality. And vice versa.”

Finally, let me bring to your attention on the question of rising inequality globally that Thomas Piketty has predicted in his now famous book, Capital in the 21st Century, Mick Brooks’ excellent review of Piketty’s work in The Project online journal (http://www.socialistproject.org/debate/review-thomas-piketty-capital-in-the-twenty-first-century/). It’s the best Marxist account that I have read – much better than mine in the Weekly Worker (http://weeklyworker.co.uk/worker/1013/unpicking-piketty/). It’s simplifying, clear and concise.

Addendum

My review of Piketty’s book has no been published in Spanish. http://rotekeil.com/2014/07/08/desmontando-a-piketty-por-michael-roberts/

The above article first appeared on Michael’s site here.